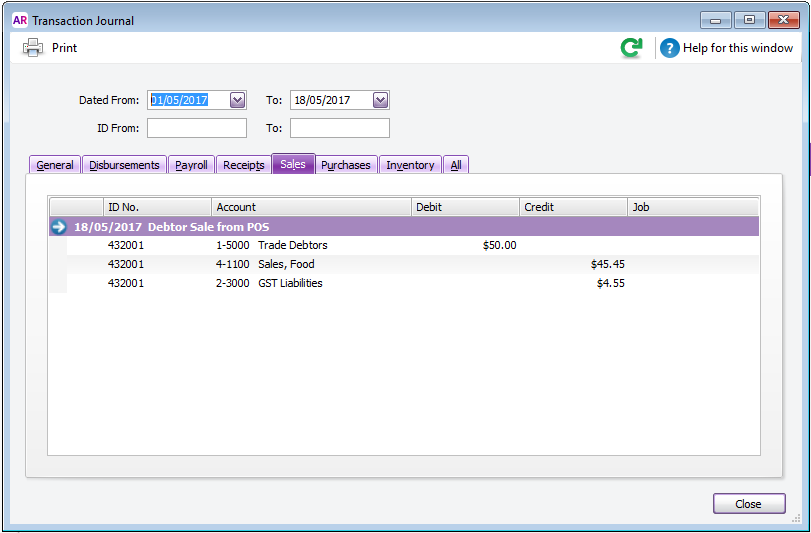

When a sale is made, and tendered on Account, the GST Amount is sent to MYOB with the sale amount if using the ‘Accrual’ GST Accounting Basis.

Account Sale – Accrual

Sale of $50.00 Inclusive of GST and tendered on Account.

Account Payment – Accrual

A payment of $50 on Account.

Account Credit Adjustment - Accrual

An Account sale of $50 Inclusive of GST with an Adjustment of $1.00 was applied to this Account to leave an outstanding balance of $49.00.

Account Debit Adjustment - Accrual

An Account sale of $50 Inclusive of GST with an Adjustment of $1.00 was applied to this Account to leave an outstanding balance of $51.00. (NB. This can only be processed when Global Debtor not activated)

An Unallocated Payment of $50 Inclusive of GST tendered on Account.

A customer has an invoice owing of $50 and they pay $60